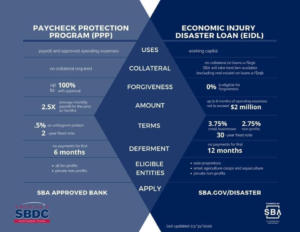

As part of the $2 trillion CARES Act, the Treasury Department has released its application and rules for the Paycheck Protection Plan (PPP). Businesses with fewer than 500 employees may consider a loan under the PPP even if they do not need cash immediately. A PPP loan provides low-cost liquidity (0.5%), will act as a safety net (through loan forgiveness) if the company is impacted, and has a funding cap of $350 billion. Potentially 100% of the loan may be wiped out if the company keeps its staff employed through the end of June and meets certain other conditions. Starting April 3rd, the PPP is open to small businesses, non-profits (501(c)(3), and veterans’ organizations but not a 501(c)(4) like WHA. Applicants must find an approved PPP lender.

The CARES Act makes Economic Injury Disaster Loans (EIDL) available now to a broader group of organizations, including 501(c)(4)s like WHA. Under the EIDL Program, the Small Business Administration (SBA) can also provide up to $10,000 in grant funding to help maintain payroll and leases. The EIDL program has higher interest rates and potentially more strings attached, but the SBA’s online application process makes the loans available quickly and easily. Thanks to Craig Rhodes from CenterPoint Energy for pointing this out and leading on WHA’s Board and the Houston Region Economic Development Alliance.

Another part of the CARES Act provides “economic impact checks” to all Americans making less than $75,000 individually and $150,000 jointly. The IRS says that it will automatically generate and send most people automatic deposits based on the account information the IRS has on file for 2018 tax returns. Americans who did not use electronic banking or did not file in 2018 are still able to get checks but need to take action. Treasury Secretary Steve Mnuchin has said that the IRS is developing a mobile app to make it easier for those who won’t receive automatic deposits to get their checks.

Ali Wolf, Chief Economist at Meyers Research, said on April 1 that stimulus checks from 2008 took up to eight weeks to arrive, which hurt economic recovery. If the checks arrive in the two weeks discussed by members of the White House and Congress, that may help with “V” shaped recovery, while a longer process may lead to a “U” shaped recovery, or even worse an “L” shaped recovery. Other experts have looked at the economic impact of COVID 19 on Houston.

Educational members have many tools available according to the American Council on Education, that cumulatively provide over $30 billion. Members with qualifying student loans may also have their loans deferred.

The 800 page cares act has many other programs in it that may be of interest to other employers, and WHA staff are looking at those programs and will provide additional information in the weeks to come.