Tax Increment Reinvestment Zones (TIRZs) are an impactful yet often misunderstood tool driving infrastructure improvements and economic development across Houston and throughout the State of Texas. In simple terms, a TIRZ is a special zone where increases in property tax revenue are reinvested back into that same area to fund public infrastructure projects towards economic development. This article explains how TIRZs work, highlights the infrastructure and community benefits they provide, and showcases success stories from several Houston-area TIRZs.

How Does a TIRZ Work? – A Self-Sustaining Funding Mechanism

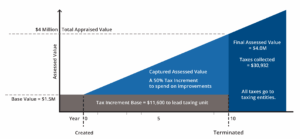

In a TIRZ, a locality “freezes” the property tax base value within the zone at the level when the zone is created. The underlying local government continues to collect taxes on that original base value, but any additional tax revenue from rising property values (the “tax increment”) is set aside for use within the zone.

Visual Representation of Tax Increment

As investment in the area is made and new development and improvements occur in the area, property values increase – generating more tax increment, which in turn funds further public infrastructure and improvements. The core idea is that retaining these incremental tax dollars locally will pay for public improvements and spur private development.

Importantly, this doesn’t require raising tax rates or creating a new tax; it simply reinvests the growth in revenue that the zone itself helps generate. In theory, after the TIRZ has catalyzed a once-stagnant area or area experiencing other barriers to development into a thriving one, the zone can eventually expire and return its now-expanded tax base to the general city budget.

This self-sustaining cycle makes TIRZs a unique funding mechanism. Public infrastructure and improvements financed by the TIRZ attract private investment, which boosts property values and creates even more revenue for reinvestment

Houston’s TIRZ program is authorized by Texas law, which defines the criteria and eligible use of the TIRZ. Generally, the law intends for these zones to be used in areas that, upon creation, had challenges impeding economic development.

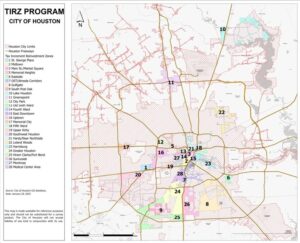

TIRZ Locations in Houston

In practice, Houston has applied TIRZs both to underserved neighborhoods in need of revitalization and to commercial areas at risk of stagnation, where additional infrastructure is required to support growth. City Council must approve the creation of each TIRZ, with each zone governed by a board of directors, guided by a project plan approved by City Council. Additionally, each Zone operates within a budget which is annually reviewed and approved by the TIRZ Board, Mayor, and City Council.

This framework ensures that TIRZ funds are invested according to a publicly adopted plan, with oversight by the City. When properly governed with transparency, TIRZs are a powerful tool to finance public infrastructure and spur economic development in specific community areas.

Investing in Infrastructure and Community Improvements

TIRZ funds can only be used for eligible public projects, generally capital improvements that benefit the zone. These often include upgrading roads and intersections, improving drainage and utilities (water, sewer lines), building sidewalks and streetscapes, creating parks and trails, installing street lighting, and other public facilities.

In essence, a TIRZ allows an area to fast-track major infrastructure projects and enhancements to the public realm that might otherwise wait years for general city funding. By design, this mechanism concentrates resources back into the neighborhood that generates them, creating a cycle of improvement.

Many of Houston’s transformative local projects have been funded through TIRZs, complementing citywide capital improvement efforts. Based on TIRZ capital improvement programs available online, these TIRZs collectively carry over $270M in investments for capital projects. When compared to overall City CIP documents, these resources represent about half of the city’s overall investment in non-enterprise funded public infrastructure.

These investments range from flood mitigation infrastructure and new public parks to street reconstructions and cultural facilities. TIRZ funding has been used, for example, to build new drainage systems and detention basins to reduce flooding in vulnerable areas, construct hike-and-bike trails and open spaces, restore or improve neighborhood parks, and enhance roadway capacity and safety in busy corridors. All of these projects improve quality of life for residents and make the area more attractive for businesses and development.

It’s worth noting that TIRZ funds are generally restricted to capital projects (physical infrastructure). They do not typically pay for day-to-day services or maintenance. This is where other entities, like management districts, often come in to complement TIRZs – more on that distinction in a future article! By focusing on one-time investments in physical improvements, TIRZs fill a critical niche: they provide the upfront financing to rebuild and modernize the public realm in a district, confident that the growth spurred by those improvements will generate the revenue to repay bonds if issued or fund additional projects. For city leaders and community stakeholders, the appeal of a TIRZ is that it creates better streets, utilities, and public spaces now, which leads to a stronger tax base in the future.

This is the first in a series of write-ups where we will highlight the role TIRZs and other special districts have played in our community. While TIRZs are often associated with major development corridors and commercial hubs, their impact goes far beyond economics. In our next article, we’ll take a closer look at how TIRZs are being used to revitalize historically underserved neighborhoods like Sunnyside and Southwest Houston, as well as how they’re supporting fast-growing areas like Memorial City. From parks and flood control to mobility and beautification, these zones are reshaping communities across Houston — sometimes in ways you might not expect.